Avoid the Costliest Tax Mistakes

Gain insights from 31 real cases and file with confidence.

Discover the most jaw-dropping true stories from the frontlines of tax preparation and IRS investigations. Before you file, read these cautionary tales to avoid becoming the next headline.

Essential insights You’ll Gain From our New Release Book !

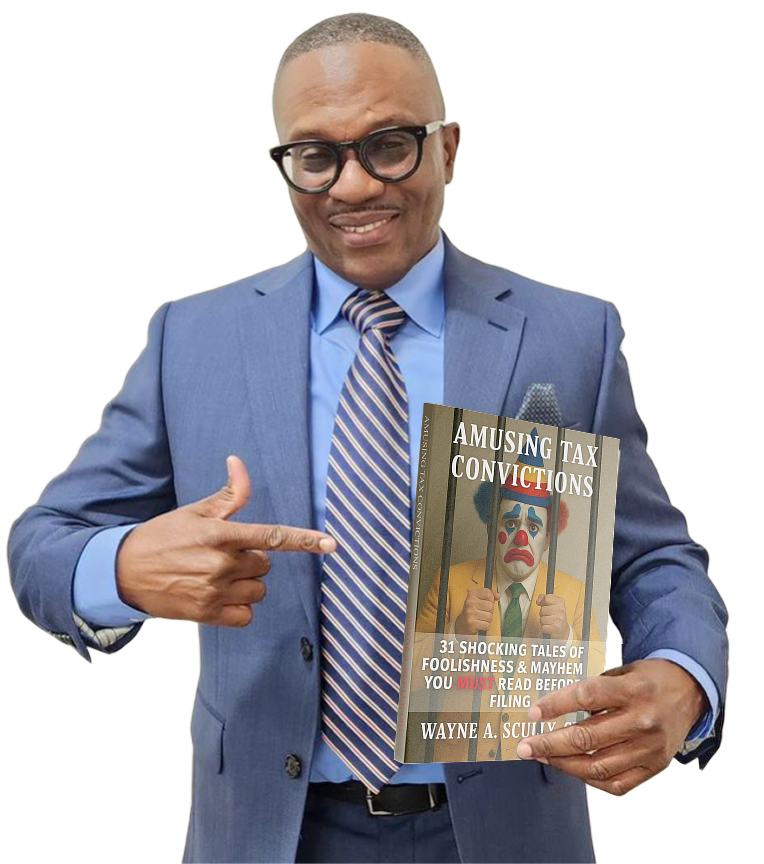

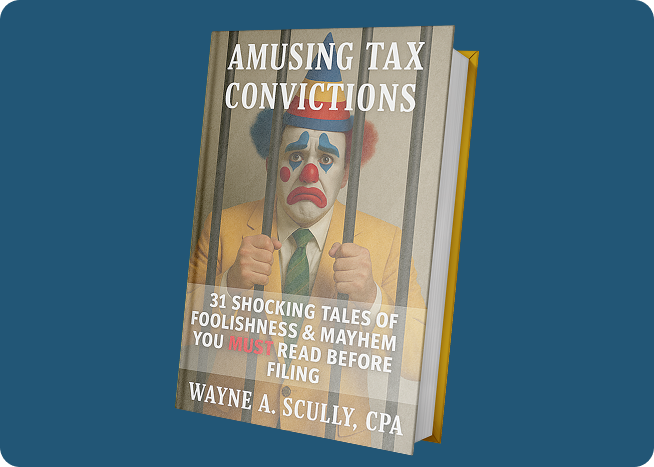

Amusing Tax Convictions

31 Real-World Cases

Explore a diverse range of true tax scenarios, each illustrating a distinct challenge and its real consequences.

Practical Lessons

Gain clear, actionable insights from every case to help you recognize risks and strengthen your approach.

Professional Analysis

Understand the factors behind each outcome, with expert commentary on prevention and best practices.

IRS Perspectives

Benefit from insider knowledge on audit triggers, compliance issues, and how the IRS identifies errors.

Guidance You Can Apply

Each chapter concludes with concise recommendations designed to support sound decision-making and protect your financial interests.

I am Wayne A. Scully

Certified Public Accountant | Certified Taxpayer Representative

With nearly 20 years of experience guiding clients through the challenges of tax law and compliance, I know just how quickly a simple oversight can turn into a costly ordeal. That’s why I’ve gathered 31 real cases, each one a powerful lesson in what can go wrong and how to prevent it.

Whether you’re a taxpayer dealing with complex rules or someone in a high-risk industry like real estate or small business, this book is built to give you the real-world knowledge you need to avoid costly mistakes, protect your finances, and file with confidence.

These real cases come with clear lessons to help you file confidently and avoid expensive mistakes.

Expand Your Tax Knowledge With Additional Resources

Explore these essential guides, each designed to help you save more, stay

compliant, and make smarter financial decisions.

21 Tax Topics to Stay Compliant & Save Money

Master the fundamentals of tax compliance and discover actionable strategies to minimize your tax burden. This guide offers clear, practical advice for individuals and business owners looking to keep more of what they earn.

Tax Knows for Real Estate Pros: The Ultimate Tax Guide for New York Landlords, Flippers, and Real Estate Investors

Unlock specialized tax insights tailored for real estate professionals. This book equips you with the knowledge to navigate complex tax laws, maximize deductions, and protect your investments.

Each book is packed with real-world examples, expert tips, and proven solutions you can rely on.

Ready to Approach Tax Season With Greater Confidence?

Every decision you make matters, especially when it comes to taxes. This collection of real cases is designed to provide clarity, perspective, and practical guidance, drawn from years of professional experience.

Gain the insight that makes a difference.

Get your copy today and move forward with assurance.

Amusing Tax Convictions: 31 Shocking Tales of Foolishness & Mayhem You MUST Read Before Filing