21 Tax Topics Every Taxpayer Should Know

This book breaks down 21 essential tax areas in plain English—designed to help you stay compliant and save money.

Clear guidance on audits, penalties, deductions, and more

Real examples and stories that bring tax rules to life

Simplifies your rights and responsibilities under the tax code

Ideal for everyday taxpayers, small business owners, and freelancers

Stay informed. Stay compliant. Save more.

Amusing Tax Convictions: 31 Shocking Stories with Real Lessons

Laugh, learn, and take notes—this book walks you through 31 true IRS cases where taxpayers made the wrong call.

Learn what went wrong—and how to avoid the same fate

Strengthen your tax awareness through unforgettable real-world examples

Each chapter ends with takeaways you can apply to your own situation

Ideal for professionals, preparers, and taxpayers who want to stay sharp

This isn’t just entertainment—it’s education through experience.

What Tax Knows for Real Estate Pros Delivers:

Tailored content for New York landlords, flippers, and real estate investors—addressing real-world scenarios unique to property professionals.

Actionable strategies packed with practical steps to maximize tax deductions, leverage credits, and avoid costly mistakes.

Legal tax advantages so you can take full advantage of every deduction and credit you’re entitled to—legally and confidently.

Expert insights highlighting the top tax errors real estate professionals make—and how to steer clear of them.

No generic advice—only real estate-focused tax solutions!

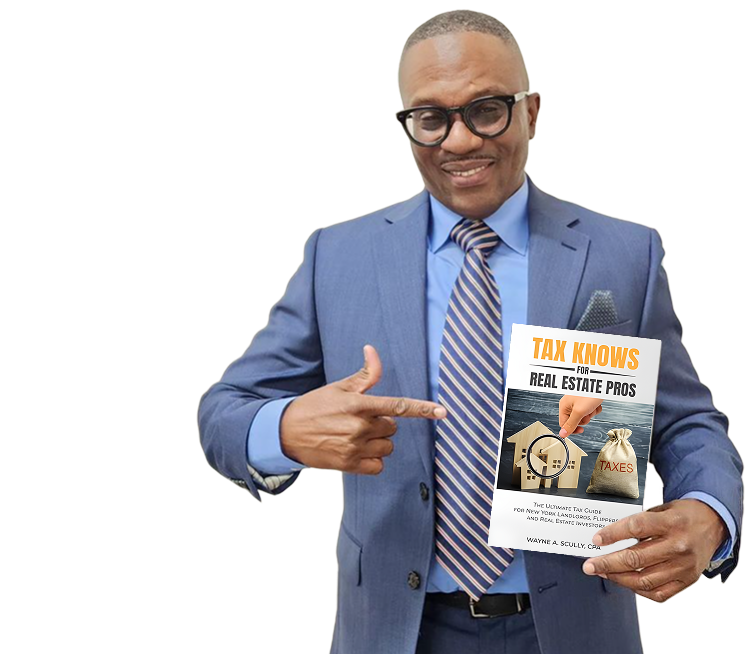

Your Trusted Source for Real Estate Tax Strategies

If you’re a landlord, flipper, or real estate investor, you already know tax mistakes can be expensive. This book helps you avoid them—before they happen.

Get expert guidance from Wayne A. Scully, CPA—real estate instructor, author, and tax strategist—on how to keep more of what you earn, legally.

Tax Knows for Real Estate Pros:

Tailored strategies for NY landlords, flippers, and investors to maximize deductions and avoid costly mistakes.

Amusing Tax Convictions

31 shocking and hilarious real-life tax blunders—an eye-opening, educational read before you file.

21 Tax Topics to Stay Compliant & Save Money

Essential tips and strategies to reduce your tax bill and stay compliant year-round.

Ready to start saving on your taxes? Grab your copies on Amazon today!

TAX ISSUES ARE COMPLICATED.

Discover the 21 tax mistakes most people overlook—and how to steer clear.

Explore practical tax knowledge through real stories, professional insights, and proven strategies.