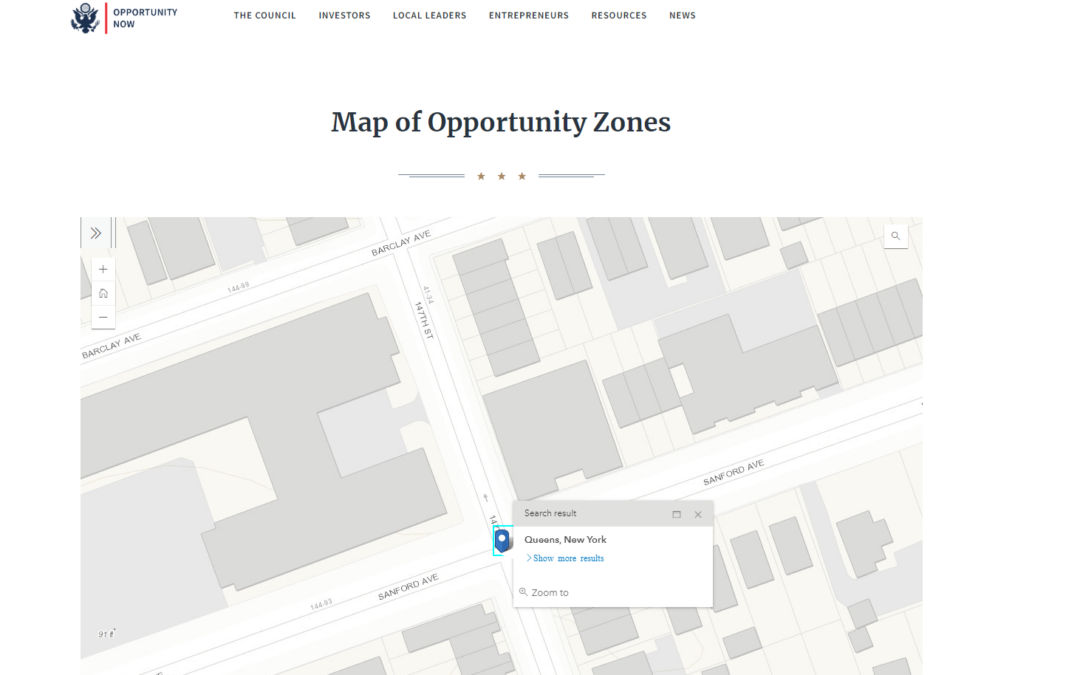

Search results for Opportunity Zones in Queens, NY

Maximizing Returns: Unraveling Tax Benefits of Opportunity Zones

In today’s financial landscape, savvy investors actively seek avenues to optimize returns while minimizing tax liabilities. Investors have increasingly turned to investing in Qualified Opportunity Zones (QOZs), a program established under the Tax Cuts and Jobs Act of 2017, as a viable avenue. Moreover, investors have actively embraced this program as a solution to balance financial growth with tax efficiency. Consequently, investors must actively understand the tax benefits of Opportunity Zones to maximize investment potential and achieve long-term financial objectives. Furthermore, investors can make informed decisions and actively capitalize on the advantages offered by QOZs by thoroughly comprehending these benefits.

Defining QOZs

According to the IRS, a QOZ is an economically distressed community where new investments, under certain conditions, may be eligible for preferential tax treatment. Localities qualify as QOZs if they were nominated for that designation by a state, the District of Columbia, or a U.S. territory, and the Secretary of the U.S. Treasury certified that nomination via his delegation of authority to the Internal Revenue Service (IRS).

Unlocking Tax Incentives

Opportunity Zones actively offer investors a unique set of tax incentives designed to spur economic development in distressed communities. Investors can actively invest capital gains in designated Opportunity Zones, deferring and potentially reducing their tax obligations, and thereby increasing the overall return on investment. Moreover, this innovative program actively provides a win-win scenario for both investors and distressed communities. Consequently, let’s actively delve deeper into the specific tax benefits available through Opportunity Zone investments, exploring how investors can leverage them to maximize returns while making a positive impact.

Tax Deferral

One of the primary benefits of investing in Opportunity Zones is the ability to defer capital gains taxes. Investors can defer taxes on capital gains reinvested in a Qualified Opportunity Fund (QOF) until the earlier of December 31, 2026, or the sale of the investment. Furthermore, the longer the investment is held, the greater the potential for tax savings. Additionally, this tax deferral benefit can be combined with other tax advantages, such as the step-up in basis and tax-free growth. Moreover, this powerful combination of tax benefits can lead to significant long-term tax savings. Therefore, investors seeking to minimize their tax liability should carefully consider Opportunity Zone investments.

Step-Up in Basis

Opportunity Zone investors can actively secure a step-up in basis, a valuable advantage. By holding the investment for at least five years, investors increase the basis of the original investment by 10%. Additionally, investors who hold for at least seven years actively gain an additional 5% increase, totaling a 15% increase. Furthermore, investors can leverage this step-up in basis to achieve substantial tax savings upon the sale of the investment. Moreover, investors can combine this tax benefit with the tax-free growth benefit, actively reducing tax liability significantly. In conclusion, investors can actively capitalize on the step-up in basis as a valuable advantage of Opportunity Zone investments.

Tax-Free Growth

Investors can actively capitalize on the potential for tax-free growth through Opportunity Zone investments. By holding the investment for at least ten years, investors can generate tax-free capital gains from the appreciation of the investment within the Opportunity Zone. This long-term tax advantage actively enhances overall investment returns. Moreover, investors can leverage this tax benefit to maximize their returns. Now, therefore, let’s actively explore the two options for getting involved: direct investments and Qualified Opportunity Funds.

Investors actively invest directly in a project or business located within an Opportunity Zone through direct investments. Consequently, investors take control and gain visibility over their investments through this approach. Furthermore, investors select specific projects that align with their investment goals and risk tolerance. Additionally, investors develop a deeper understanding of the project or business through direct investments, enabling them to make more informed decisions.

QOFs actively invest in Opportunity Zone projects, providing a specialized investment vehicle for investors. Moreover, they pool investors’ capital and actively deploy it into various Opportunity Zone projects, providing diversification and professional management. Additionally, this structure enables investors to actively benefit from the expertise of experienced fund managers and access a broad range of Opportunity Zone investments. Therefore, QOFs actively offer an attractive solution for investors seeking to capitalize on the tax benefits of Opportunity Zones while minimizing risk.

While the tax benefits of Opportunity Zones are compelling, investors must take action to navigate a complex set of compliance requirements to fully capitalize on these incentives. Additionally, investors must ensure that they make investments in Qualified Opportunity Zones and compliant Qualified Opportunity Funds to avoid potential tax pitfalls. Moreover, investors can partner with experienced tax professionals and legal advisors to navigate these complexities and optimize their investment strategies. Therefore, investors should prioritize compliance and actively seek expert guidance to maximize their returns.

In conclusion, investors must understand the tax benefits of investing in Opportunity Zones to maximize returns while minimizing tax liabilities. Moreover, investors can seize a compelling opportunity for long-term financial success by deferring capital gains, benefiting from a step-up in basis, and potentially achieving tax-free growth through Opportunity Zone investments. However, investors must navigate compliance requirements to fully capitalize on these incentives. Furthermore, investors can unlock the full potential of Opportunity Zone investments and achieve their financial objectives with strategic planning and expert guidance. Ultimately, investors who actively take advantage of Opportunity Zone investments can reap significant tax benefits and achieve long-term financial success.

Are you a real estate professional and need help with your tax/retirement planning or accounting? I am here for you! Please contact Wayne Scully (https://wscullycpa.com/about/) by e-mail at [email protected] or by phone at 718.938.4601.

Get a FREE! FREE! copy of Wayne’s tax resolution book here: www.getmytaxbook.com

Thanks for reading “Maximizing Returns: Unraveling Tax Benefits of Opportunity Zones”. Wanna get more of my real estate centric content? Then check out my Real Estate playlist: https://youtube.com/playlist?list=PLaauMNiboYq0VM7kdkx5EqUSPAJ1eLCcp&si=6BuDhWqawCJXhh1n

The IRS has a ton of information about Qualified Opportunity Zones (QOZs) and Qualified Opportunity Funds (QOFs). Check it out here: https://www.irs.gov/credits-deductions/opportunity-zones-frequently-asked-questions

Note: This post may contain parts generated with the assistance of artificial intelligence. Thank you for reading!